Shipping Companies Halt Major Asia-Europe and Asia-US Routes! Concerns Over Another Freight Rate Plunge?

Logistics News

![]() 3-Sep-2024

3-Sep-2024

Ahead of China's National Day holiday in early October, shipping companies have canceled numerous export shipping plans from Asia to Europe and the United States. Industry insiders believe this move is driven by concerns over another potential plunge in container spot freight rates.

The latest blank sailings assessment from Drewry shows that, as of now, the announced cancellation rate for scheduled trans-Pacific, Asia-Europe, and trans-Atlantic sailings in September is at 10%.

Drewry reports that 51% of the canceled sailings announced so far are on trans-Pacific routes, 28% on Asia-Europe routes, and 21% on trans-Atlantic routes.

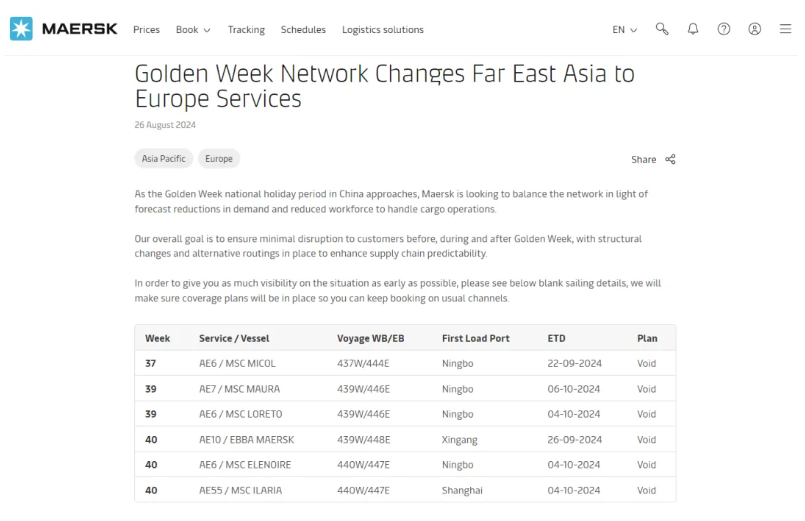

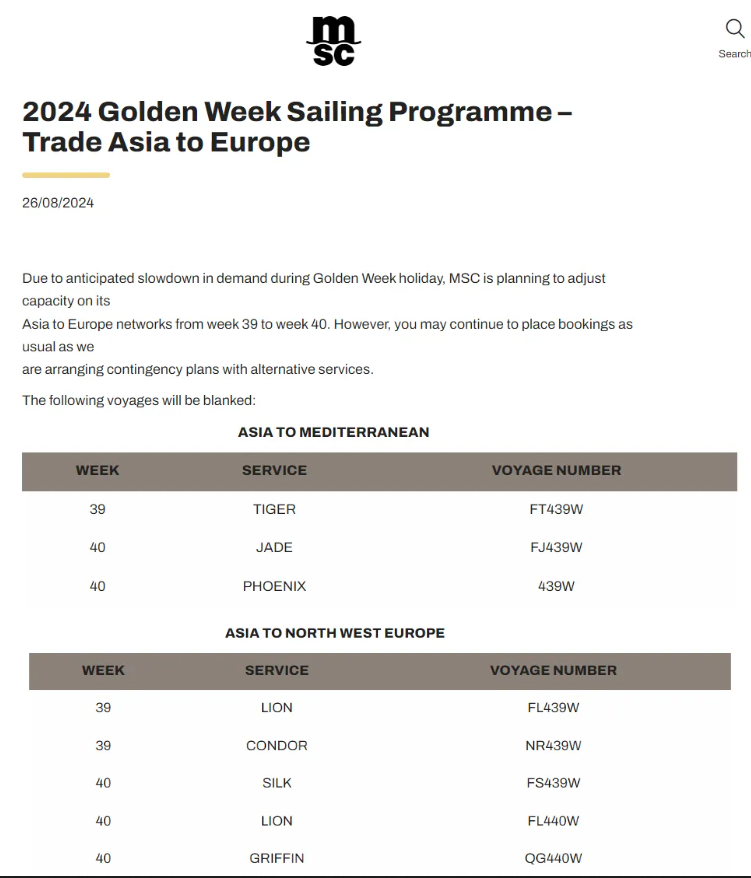

Recently, major shipping lines like MSC and Maersk have issued announcements about suspending sailings. In a customer notice, Maersk mentioned that due to the anticipated decline in demand, they are seeking to balance their network. Meanwhile, their 2M alliance partner MSC stated that due to expected demand slowdown, they will adjust capacity in weeks 39 and 40.

Maersk Golden Week Sailing Suspension Plan

MSC Golden Week Sailing Suspension Plan

Although spot freight rates from Asia to Europe and on trans-Pacific eastbound routes have been steadily declining for weeks, there is no evidence yet that large shipping companies will offer significant discounts, leading to a rate crash.

In fact, Drewry’s WCI Asia-North Europe sub-index is still about 350% higher than it was 12 months ago, standing at $7,204/FEU, a 3% drop this week.

However, this week, some industry media outlets reported receiving short-term offers from Ningbo to Felixstowe at $5,000/FEU, valid for September, while another UK NVOCC reported receiving offers from China to Southampton at $4,500/FEU. The NVOCC commented: “We believe there could be further price cuts as the alliances restructure.”

Meanwhile, trans-Pacific rates remain strong, with WCI spot rates to the US West Coast dropping only 2% this week to $6,248/FEU, and US East Coast rates also down 2% to $8,591/FEU. However, spot rates on trade routes from Asia to the US West Coast and East Coast are still at high levels, up 180% and 150% year-on-year, respectively.

While shipping companies have deployed some capacity management strategies on trans-Pacific routes, the potential threat of port strikes on the US East Coast in October and the introduction of new import tariffs should support rates on this route, despite the softened demand and new smaller shipping lines undercutting prices.

On other routes, the westbound trans-Atlantic route from Northern Europe to the US East Coast has seen stable spot rates, around $2,000/FEU, as exporters rush to ship before potential industrial action at East Coast ports.

Last

Freight Rate War Erupts! "New Entrants" Challenge Shipping Giants

A fierce freight rate war is unfolding on the Asia-US West Coast trade route. New trans-Pacific carriers, eager to capture market

Next

Maersk Invests $250 Million to Build a Mega Logistics Park

In the global supply chain and logistics industry, efficiency and sustainability have become the new competitive focal points. Rec