Shipping Market Hit by Unexpected Chill: Risks and Opportunities Behind 10-Week Freight Rate Decline

JCtrans News

![]() 25-Mar-2025

25-Mar-2025

The shipping market in March seems to have been struck by an unexpected cold snap. The Shanghai Containerized Freight Index (SCFI) has fallen for the tenth consecutive week since the beginning of the year, dropping 2.02% to 1,292.75 points on March 21—a nearly six-month low. All four major trade lanes were in the red, with rates on the U.S. West Coast route even plunging below cost levels, while the South America route plummeted 13.62% in a single week, dousing the shipping industry with cold water.

Slowdown on Europe and U.S. Routes

The Europe route bore the brunt of the decline, with spot rates from Shanghai to Europe falling to 1,306 per TEU (20-foot equivalent unit), while the Mediterranean route dropped to 1,306 per TEU (20−footequivalentunit), whiletheMediterraneanroutedroppedto2,195 per TEU, down 2.68% and 4.36%, respectively. More concerning is that some carriers have quietly lowered spot rates on the Europe route from the 1,800–1,900 range to 1,800–1,900 rangeto 1,600–1,700 nearly halving from their 2023 peak. On the trans-Pacific routes, U.S. West Coast rates fell below the 2,000 per FEU (40-foot equivalent unit) threshold to 2,000 per FEU(40−footequivalentunit) thresholdto 1,872, while the U.S. East Coast route managed to hold at $2,866 but still saw a 3.73% decline from the previous week.

Life-or-Death Game Below Cost Levels

The market has now entered a phase of "price wars." U.S. West Coast rates are below carriers' breakeven point of $2,500–3,000 per FEU, while the Europe route is barely scraping by at cost levels. Industry insiders reveal that some smaller carriers are sacrificing profits to gain market share, while leading players are maintaining pricing power by reducing capacity. This "prisoner's dilemma" competition has led to double-digit declines on emerging market routes like South America, exposing the structural imbalance between overcapacity and weak demand.

April Hints at a Potential Turnaround

Yet, there are glimmers of hope in the gloom. The U.S. reciprocal tariff policy will be finalized on April 2, and as a new cycle of Sino-U.S. trade begins, cargo volumes on North American routes are expected to rebound. Several carriers plan to implement General Rate Increases (GRI) in April, with giants like Maersk and CMA CGM already signaling rate hikes. Although actual transaction prices remain unchanged for now, the ripple effects of the Red Sea crisis—which has slashed Suez Canal traffic by 30% and reduced global container ship turnover efficiency by 12%—are still unfolding. If cargo demand rebounds, the supply-demand balance could shift abruptly.

Market analysts widely predict that current freight rates have hit a temporary bottom. With the end of Ramadan, the restocking cycle in Europe and the U.S., and carriers' capacity reduction strategies, the likelihood of a rebound in Q2 continues to rise. As one shipping analyst put it: "The current calm may well be the lull before the storm."

Last

USPS Nationwide Strike! 10,000 Job Cuts, Over 6,000 Post Offices Shut Down, Cross-Border Logistics Severely Impacted

According to the Associated Press, US Postmaster General Louis DeJoy recently sent a letter to Congress outlining plans to cut 10,

Next

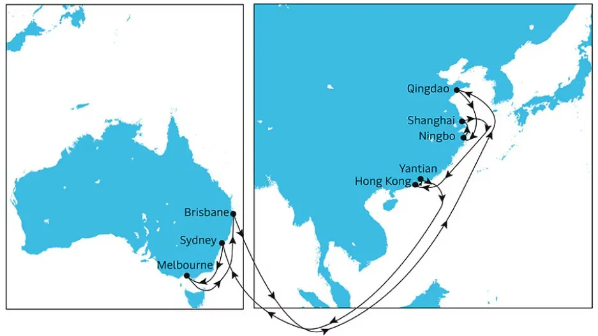

Maersk Announces Port Omissions! Some Vessels to Skip Shanghai/Ningbo Ports

Recently, Maersk issued a notice on its official website stating that, with the fog season approaching, it will implement key oper