The MSC container ship has been stranded for over a month, and the salvage operation has made new progress!

JCtrans News

![]() 24-Mar-2025

24-Mar-2025

On March 21, COSCO SHIPPING Holdings Co., Ltd. released its 2024 annual report. In 2024, driven by the gradual recovery of global trade, the container shipping market experienced moderate growth in cargo volume. Meanwhile, ongoing instability in the Red Sea led to an overall shortage of effective shipping capacity, keeping freight rates at relatively high levels. Against this backdrop, COSCO SHIPPING Holdings actively seized market opportunities, advanced digital intelligence and green, low-carbon transformation, and achieved the goals of strengthening and stabilizing supply chains while ensuring high-quality development. As a result, its business performance was outstanding.

Net Profit Attributable to Shareholders Doubles

According to corporate accounting standards, in 2024, the company achieved an operating revenue of RMB 233.86 billion, marking a year-on-year increase of 33.29%. Operating costs amounted to RMB 164.77 billion, up 12.29% year-on-year. Earnings before interest and tax (EBIT) reached RMB 69.95 billion, a 90.74% increase compared to the previous year. The company recorded a net profit of RMB 55.40 billion, reflecting a 95.08% year-on-year growth. The net profit attributable to shareholders of the listed company stood at RMB 49.10 billion, representing a 105.78% year-on-year increase.

Strong Performance in Core Business Operations

The company’s main business operations showed a positive trend. The container shipping segment completed a total of 25.94 million TEU in billable volume, growing by 10.12% year-on-year, and achieved revenue of RMB 225.97 billion, reflecting a 34.40% increase. Meanwhile, the terminal business recorded a total throughput of 144.03 million TEU, an increase of 6.06% year-on-year, and generated revenue of RMB 10.81 billion, up 3.98%.

2024 Development Highlights and Strategic Layout of COSCO SHIPPING Holdings

I. Accelerating Global Expansion

- Fleet capacity exceeded 3.3 million TEU, covering 629 ports across 145 countries. An additional 12 new vessels of 230,000 TEU class were deployed on Europe-America and Latin America routes.

- Ongoing expansion of port network: Chancay Terminal in Peru commenced operations; Sokhna Terminal in Egypt was successfully acquired; an investment agreement was signed for Laem Chabang Port in Thailand; Abu Dhabi Terminal's throughput exceeded 6 million TEU, marking a 30% growth over three years.

- Strengthening shipping alliances: Extended the partnership with the Ocean Alliance until 2032 and introduced new DAY8/DAY9 shipping routes.

II. Digital Intelligence Empowering the Entire Logistics Ecosystem

- Established 8 overseas investment platforms and 9 supply chain operation platforms, with non-shipping revenue reaching RMB 40.94 billion (up 18.09% year-on-year).

- Technology applications: Over 380,000 blockchain-based electronic bills of lading issued; My Reefer smart refrigerated container platform expanded to Australia and Southeast Asia.

- Innovative product offerings: Launched 38 digital supply chain solutions, including "New Land-Sea Corridor + Central Asia Freight Train," now serving over 90 countries and regions.

III. Leading Green Shipping Transformation

- Methanol-powered vessel deployment: Signed contracts for 12 new 14,000 TEU dual-fuel methanol-powered ships, bringing the total green fleet capacity to 590,000 TEU (32 vessels).

- Industry leadership: Completed the largest biofuel bunkering operation in China and expanded the application of the Hi-ECO green certification system.

- Smart terminal upgrades: Nationwide implementation of energy efficiency management platforms and large-scale operation of intelligent container trucks.

IV. Value Creation Through Capital Operations

- Strategic investments: Participated in Midea’s H-share IPO, acquired stakes in Yantian Port and Anji Logistics, and increased stake in logistics supply chain operations to 19%.

- Shareholder returns: Maintained a 50% dividend payout ratio for three consecutive years, with investment returns reaching RMB 4.8 billion in 2024.

- Share buybacks: Repurchased A/H shares worth a total of RMB 3.56 billion (as of March 21, 2025), with inclusion in the CSI and SSE Dividend Indices.

Last

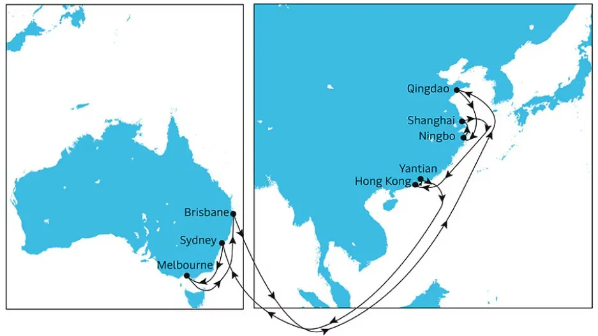

Maersk Announces Port Omissions! Some Vessels to Skip Shanghai/Ningbo Ports

Recently, Maersk issued a notice on its official website stating that, with the fog season approaching, it will implement key oper

Next

The MSC container ship has been stranded for over a month, and the salvage operation has made new progress!

On February 15, the MSC Baltic III, a container ship (33,767 deadweight tons), ran aground near Wild Cove, Newfoundland. Due to it